In our Fixed Income Fundamentals article, we examined the basics. To recap, a fixed income investment is a simple interest only loan, made to a government, semi-government authority or company; as such, fixed income investments are often referred to as ‘debt’ investments. In this article, we’ll focus on the types of fixed income securities available, the diversity of fixed income investments and the credit market.

Short dated vs long dated

Those issued in the Australian market may have terms ranging from less than one year to up to 30 years. Australian securities with maturities of one year or less are referred to as short-dated or money market securities.

As a rule of thumb, the longer the term to maturity, the higher the rate of interest the securities pay. This compensates investors because the risk of lending money over a longer time period is greater than the risk of lending over shorter time periods.

Types of fixed income securities

There are three broad categories of fixed income securities available to Australian investors; money market securities, bonds and credit as outlined in figure one.

|

Money market securities |

Short term assets, generally with a maturity less than a year, include 90-day bank bills, certificates of deposit (CDs), Treasury bills (T-bills) and promissory notes. They are generally a source of funding for banks, institutions and corporates. |

|

Bonds |

Government bonds Semi government bonds |

|

Credit |

Corporate bonds Floating rate notes (FRN) Securitised assets RMBS ABS Private loans Cash |

Figure one: Fixed income securities

Capital structure

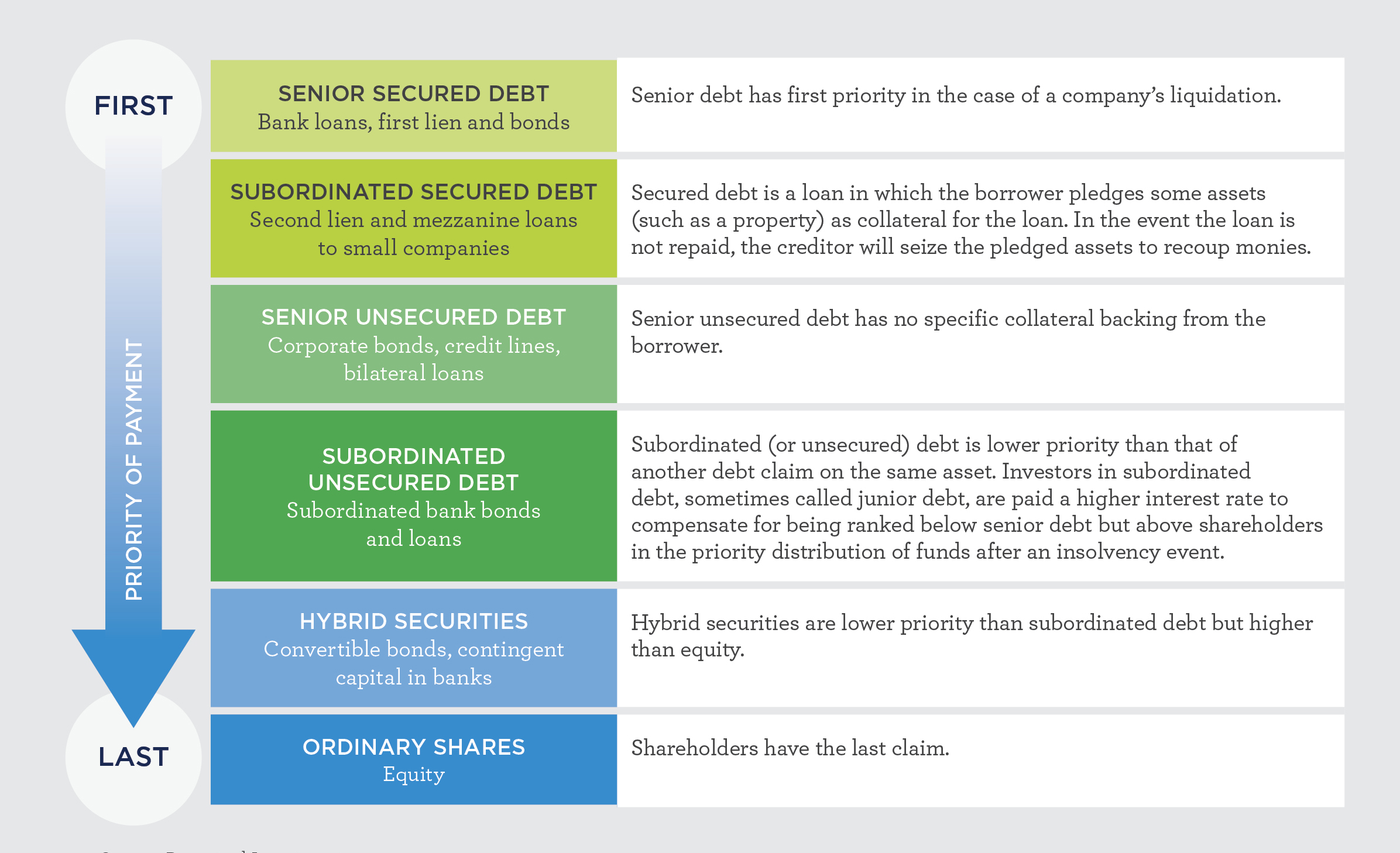

When investing in fixed income securities, it’s important to consider the capital ranking of each security; this indicates the price stability of each. Figure two illustrates how investors in debt assets fare in the event of a company being wound up. Investors in fixed income assets, such as secured or unsecured debt, typically rank higher in priority and should have their invested capital returned to them before capital is returned to investors in hybrid securities or shares.

Figure two: The typical capital structure of a company

Figure two: The typical capital structure of a company

Each company will have its own capital structure which may differ from the typical capital structure shown in figure two.

Diversity of the fixed income market

Fixed income markets in Australia and most developed countries are mature and diverse. Using Australia as an example, it has a well-developed money market, the federal government issues bonds with different maturity profiles, as do semi-government bodies.

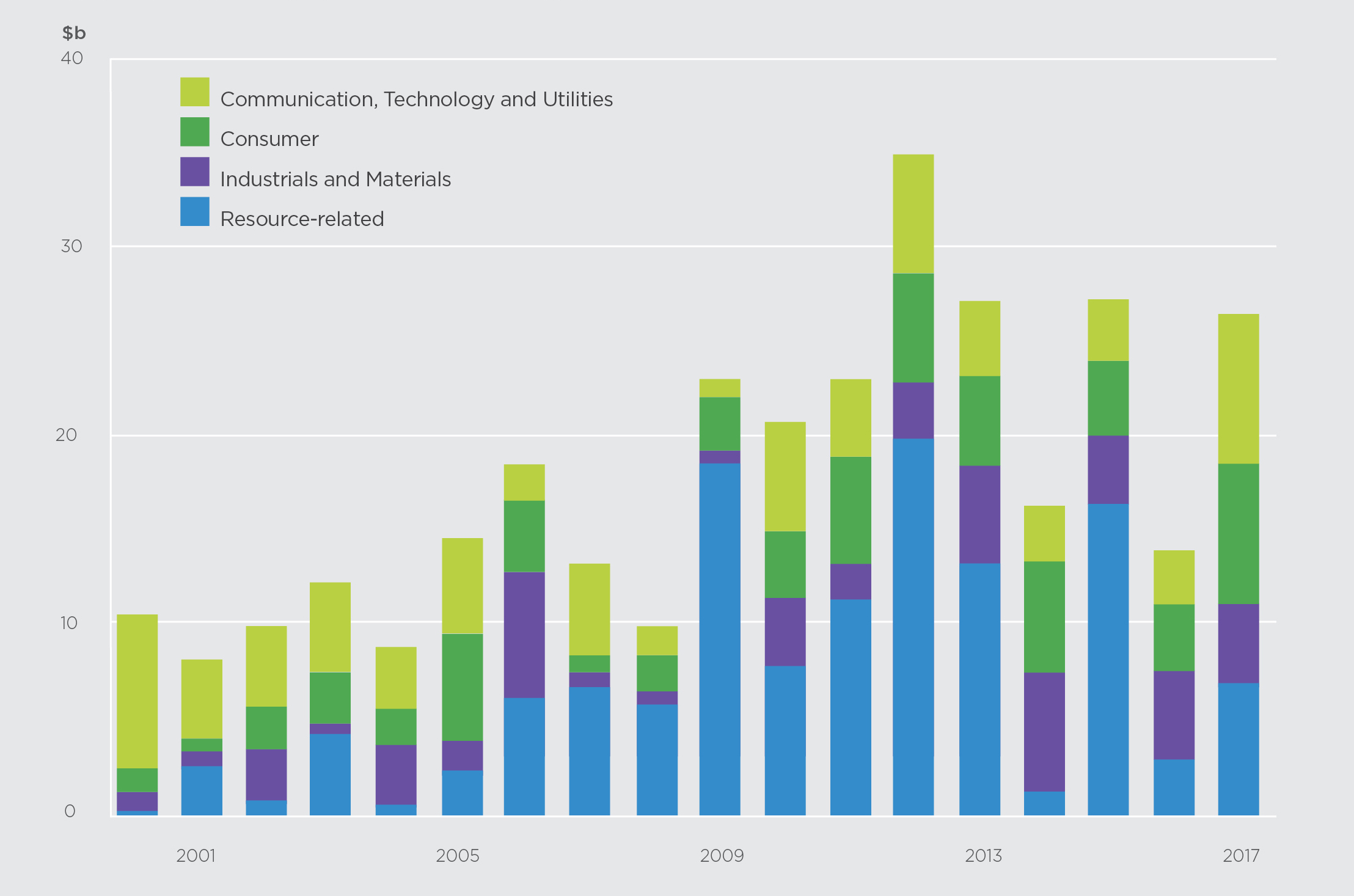

In the same vein, just as the Australian sharemarket has hundreds of companies which operate in different industries that issue shares, a number of Australian companies also issue corporate bonds. Figure three provides a breakdown of the types of Australian companies that have issued corporate bonds since 2000, totaling hundreds of billions of dollars.

Figure three: Corporate bond issuance by category

Figure three: Corporate bond issuance by category

Source: RBA, Australian Fixed Income Securities in a Low Rate World (14 March 2018)

The credit market

A sub-section of the fixed income market is the credit market. The credit market includes all non-government fixed income assets, such as those highlighted in figure two.

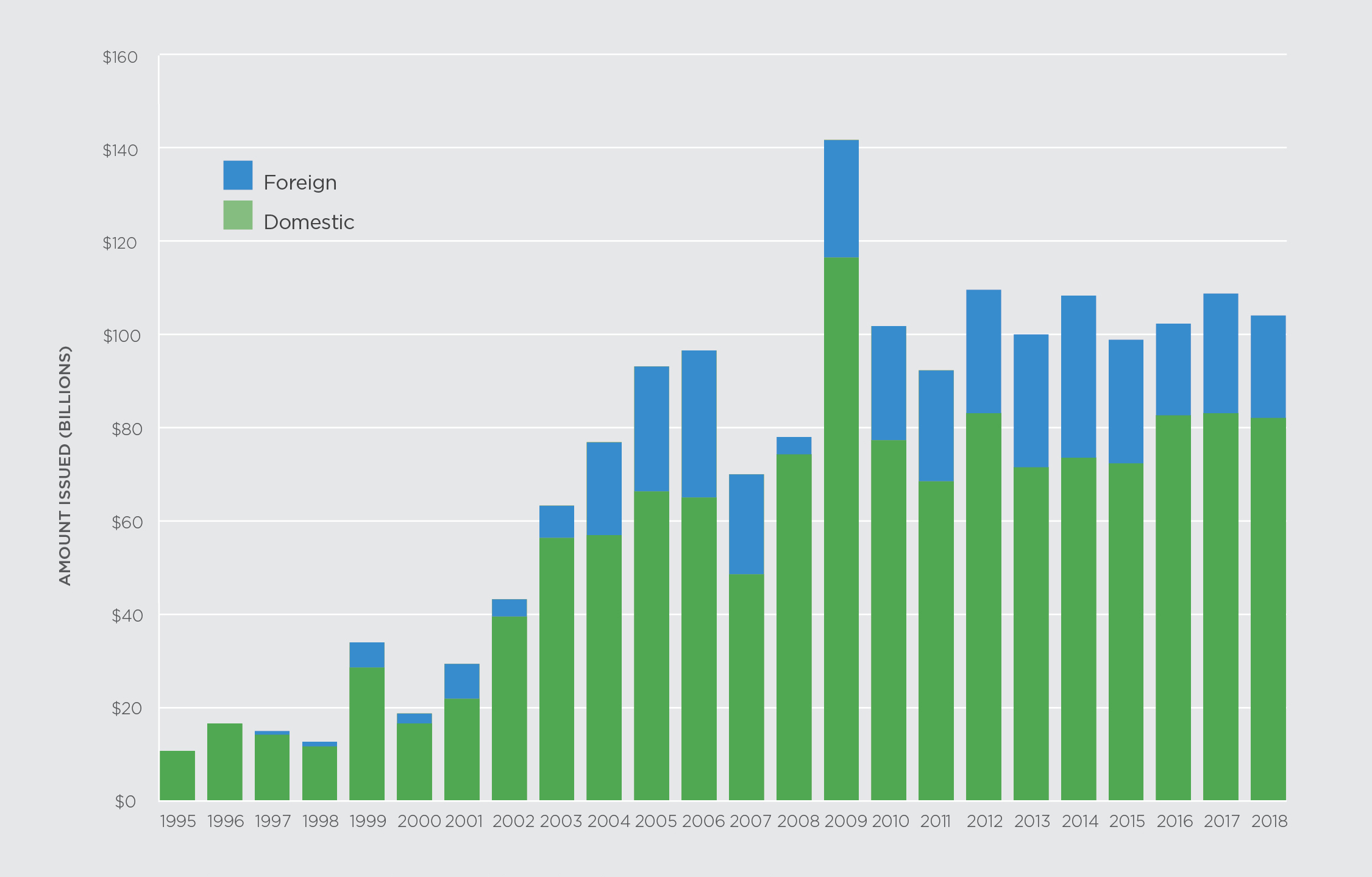

The Australian non-government debt market – or credit market – has grown eight fold over the 25 year period ending August 2018, from approximately $0.1 trillion to over $0.8 trillion in size.

The number and amount of debt assets on issue in Australia has been growing, from both domestic and foreign issuers (see figure four). Corporate bonds now represent approximately one third of the total Australian debt market. For investors, this means the corporate bond market in Australia is increasing in scale, diversity and liquidity.

Figure four: Credit issuance in Australia by domestic and foreign issuers

Figure four: Credit issuance in Australia by domestic and foreign issuers

Source: Perpetual Investments, using data sourced from Bloomberg as at 31 December 2018

Generally, individual investors find it difficult to create a diversified portfolio of fixed income assets because certain securities are typically issued into wholesale or institutional markets. To ensure a diversified exposure to fixed income – including exposure to different countries, industries, asset types, ratings and issuers – can require large sums of money and market expertise.

To illustrate, some fixed income securities can be easily purchased on an exchange such as the ASX; others, such as private debt or corporate loans, are only offered privately to a select group of investors. While not impossible, fixed income is not an asset class where investors can easily adopt a DIY approach. On the other hand, this diversity offers investors such as Perpetual broad investment choice in terms of risk and reward based on credit quality, yield and term to maturity.