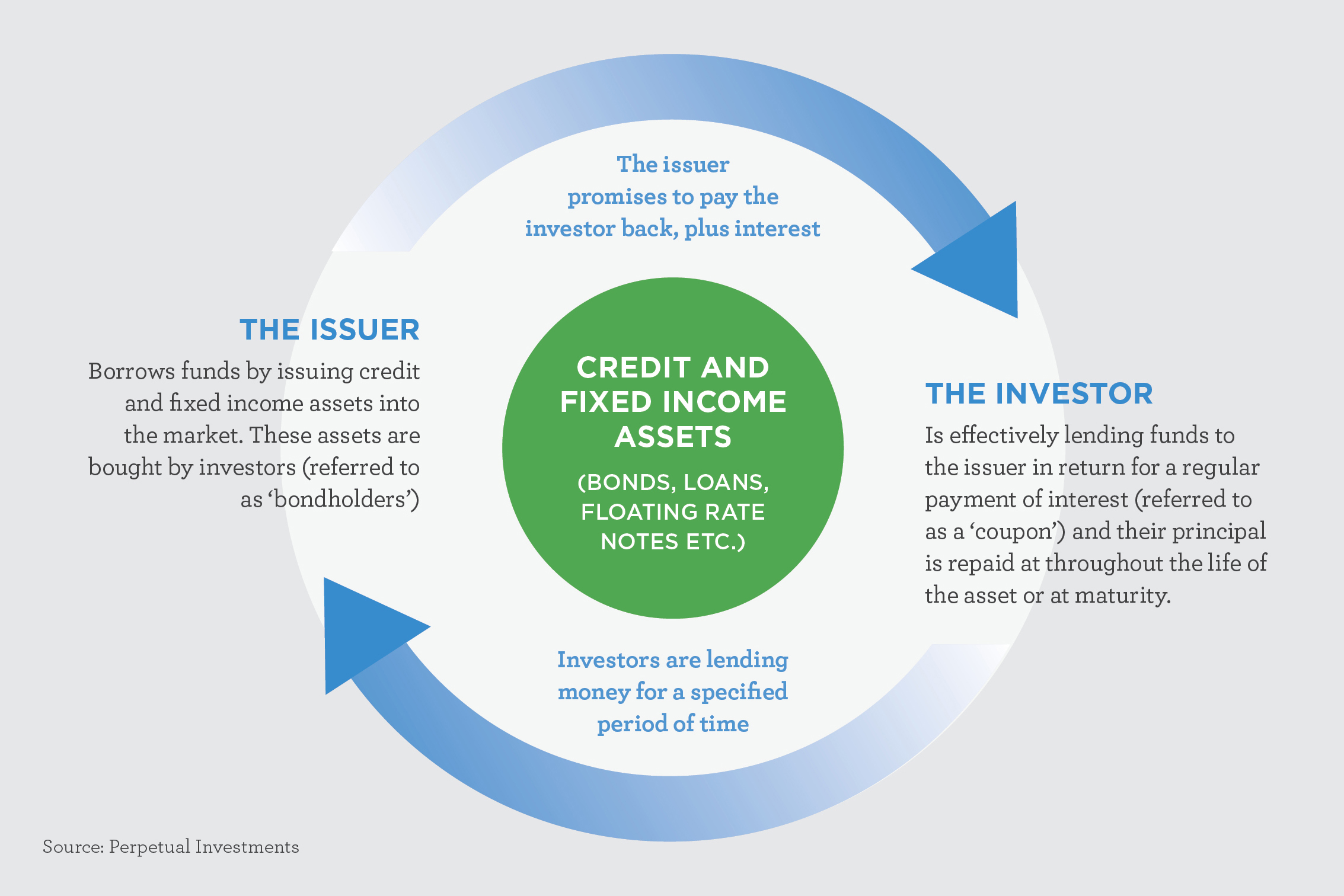

A fixed income investment is a simple interest only loan. It may be made to a government, semi-government authority or company; as such, fixed income investments are often referred to as ‘debt’ investments.

A fixed income investor agrees to purchase a fixed income asset from an issuer in exchange for interest payments (or coupons) over time and repayment of the principal at maturity. The investor acts as a lender and the issuer acts as a borrower. So, investors in fixed income are simply lenders of capital.

When you buy a fixed income investment, you are lending a certain amount of money for a specific amount of time. You receive scheduled interest payments of fixed amounts at fixed times - hence the term ‘fixed income’.

At end of the term, you - or the fixed income fund you’re invested in - get your money back; if the security was bought at issue, the full value is returned. If the security was purchased during its term, the face value is returned upon maturity.

This interaction between the issuer and investor is illustrated in figure one.

Figure one: Interaction between the issuer and investor.

Demystifying fixed income

Fixed income has specific terminology - or jargon - you may encounter. In fact, we’ve already used it in the introduction to this article. It can seem confusing at first glance, as it isn’t terminology investors come across every day - and rarely features in the finance or sharemarket section at the end of the news each evening.

The most commonly used terms in reference to fixed income are defined in figure two.

|

Term |

Definition |

|

Issuer |

The government,semi-government authority or company that sells fixed income securities to raise money for its operations. The issuer is responsible for paying interest and repaying the ‘loan’ amount in full when the security matures |

|

Coupon |

The interest rate of a fixed income security; interest payments are referred to as coupon payments or coupons. Coupons may be paid monthly, quarterly, half-yearly or annually |

|

Principal |

The price paid for the security |

|

Term |

The length of time until the fixed income security matures |

|

Maturity |

The time at which a fixed income security will be paid in full by the issuer |

|

Par value |

The face value of a fixed income security; it determines the maturity value and coupon payments of the security |

|

Duration |

A measure of the sensitivity of the price of a fixed-income security to a change in interest rates; generally, the longer the duration, the more sensitive the security is to rising or falling interest rates |

Figure two: Common fixed income terms.

Did you know...

When referring to different types of issuers in credit and fixed income in Australia, 'semi government' simply refers to the various state and territory governments. When these authorities or state governments issue bonds, they will often carry a slightly higher credit risk over similar Commonwealth Government bonds. They will usually feature different credit ratings from one another too – designed to reflect the creditworthiness of each individual state government.

Fixed income features

Fixed income securities have a range of features. Although a broad range of securities get put in the fixed income bucket, it’s important for investors to understand the differences that may exist.

|

Secured or unsecured |

Secured means there is some form of security backing the asset; for example, a business loan might be secured against a commercial building by way of a mortgage. Unsecured means there is no security backing the asset. |

|

Fixed or floating rate |

A fixed rate means the interest rate of the asset is set and the dollar value of the interest payment will be the same every period. Floating rate assets have a variable interest rate; the interest rate may change, usually in line with an official interest rate such as the 90- day Bank Bill Swap Rate. The interest payment on a floating rate asset will typically move up or down as interest rates move up or down. |

|

Rated v unrated |

Fixed income assets can be rated by a ratings agency such as Moody’s or Standard & Poor’s, or unrated. Credit ratings reflect the rating agency’s opinion about credit risk; the ability and willingness of an issuer to meet its financial obligations on time and in full. Ratings agencies usually assign a corporate rating applying to the issuer, as well as a specific rating for each debt asset issued for which a rating has been requested. |

|

Ratings |

Ratings only consider credit risk, not other forms of risk, and often take time to update when a credit event happens. Ratings range from C to Aaa or D to AAA, depending on the ratings agency, with Aaa/AAA being the highest rating. |

|

Investment grade |

Rated assets are further classified as investment grade or sub-investment grade. An investment grade asset has a rating of BBB-/Baa3 to AAA/Aaa. A sub-investment grade asset has a rating below BBB-/Baa3. |

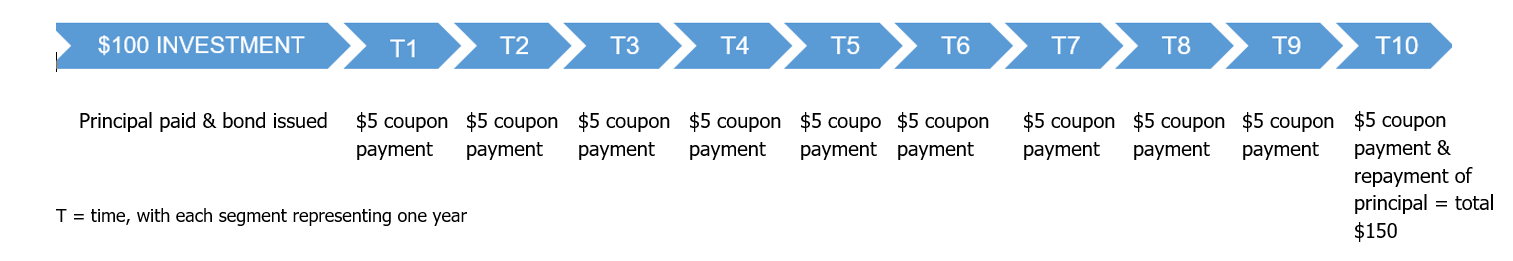

Figure three: From issue to maturity.

How fixed income works

The best way to understand a fixed income investment is to examine it from issue to maturity.

Fixed income securities are originated in the primary market, from where they are sold to investors. Because the minimum transaction in the primary market is usually large, most fixed income issues are bought by wholesale investors such as fund managers.

Using a very simplistic example, if an investor bought a 10-year government bond at issue for $100, received an annual coupon of 5%, and held it to maturity, the cashflow would look like this. The investor would receive coupon payment/s each year, totalling 5% and, at maturity, the principal – or loan – is repaid.

Figure four: Yield and price.

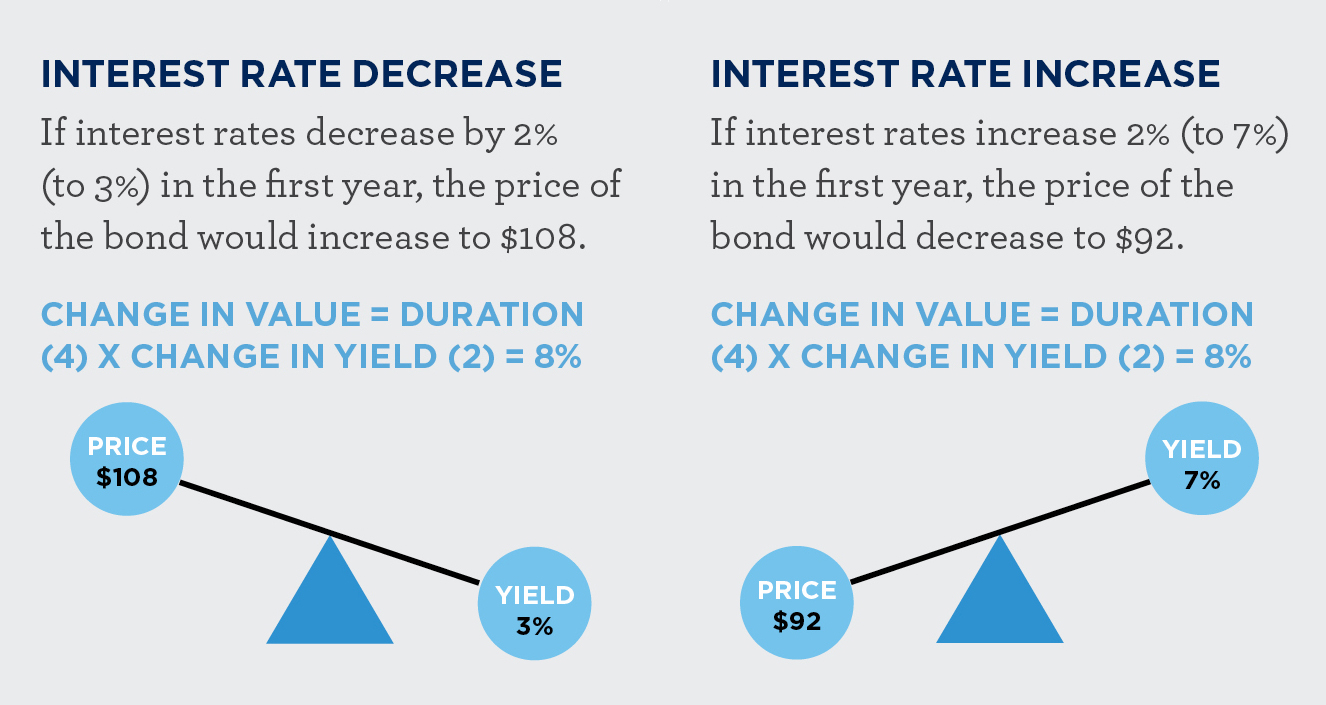

Although some investors buy and hold fixed income securities from issue to maturity, they are commonly traded in the secondary market. A number of factors - such as central bank policy, interest rate moves and the economic environment - can impact a security’s face value and yield once trading in the secondary market commences.

It’s important to note that fixed income securities may trade at a premium or a discount to their face value.

If you (or the manager of a fixed interest fund) buy a fixed income security after its issue date, or sell before the maturity date, you may get more or less than the issue price because the price of a fixed income security has an inverse relationship to that security’s yield.

As illustrated in figure five, when the yield decreases, the value of a fixed interest security increases. Likewise, an increase in the yield results in a decrease in the security’s price. Changes in the price of fixed income securities have the equivalent impact on the security’s yield.

For illustrative purposes, assume a $100 par value with an interest rate of 5% pa with a duration of 4 years.

|

Yield |

Price |

|

3% |

$108.18 |

|

5% |

$100 |

|

7% |

$92.56 |

Figure five: Yield and price.

Figure five: Yield and price.

Fixed income has a natural buyer in the issuer, who is required to pay back the loan at par value when it matures. This, along with its regular coupon payments, gives fixed income a greater predictability of returns and, in turn, makes this asset class an important part of a diversified portfolio.