Australia’s fixed income market has evolved to become a more attractive destination than many of its global peers. Perpetual’s head of credit research and senior portfolio manager Greg Stock explains why.

- Strong regulatory framework

- Opportunities for active fixed-income investors

- Find out about Greg Stock’s Perpetual Active Fixed Interest Fund (Class A)

Australia is now offering some of the best fixed-income opportunities in recent history, making it an attractive destination for investors.

That’s according to Greg Stock – head of credit research and senior portfolio manager for the Perpetual Active Fixed Interest Fund, which he’s been managing for almost two decades.

Stock joined Skye Masters, head of research for National Australia Bank, for a recent webinar to discuss the evolution, risks and opportunities playing out in the Australian fixed income space.

You can watch the webinar on-demand here.

The Australian fixed-income market has continued to expand despite a confluence of challenging conditions in recent years – from a global pandemic, to the winding and unwinding of central bank monetary policy, and flow-on complications from the US banking sector.

That’s thanks, in large part, to Australia’s strong regulatory framework, argues Stock.

Here, institutions like the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) regulate and supervise the conduct of participants.

“After events like the Global Financial Crisis and the Hayne Royal Commission, Australia’s financial regulatory oversight has remained incredibly comprehensive,” Stock says.

“We haven’t had the same level of relaxation that other jurisdictions have had.

“Look at the US regional banking sector, for example – some of the problems there in recent years were due to a relaxation in the regulatory oversight of smaller institutions.”

Strong regulatory framework

Australia’s regulatory framework has placed it among the highest-rated countries in the world in terms of banking regulation and credit worthiness – with agencies like Standard and Poors recently upgrading the underlying risk assessment of Australia.

“As a country that has historically been dependent on foreign equity and debt capital inflows to help fund infrastructure investment, we’ve had to be worthy of investment to attract investors as a destination for capital – in both equity and debt,” Stock says.

Adding to Australia’s curb appeal is a shorter bond duration – just under five years compared to more than six years in the US – which can add an additional layer of defence.

“Not only do we have a high-grade market, but we also have a defensive one which is unique given the size of the economy.

“The investment-grade corporates here have strong profiles due to Australia’s small population but large landmass – resulting in oligarchic-style industries with fewer competitors.

“That’s good for creditors and debt holders.”

High levels of market liquidity mean Australia’s fixed income landscape is more developed than ever, he says.

With an expanding opportunity set that is expected to remain buoyant in the next year, investors are “spoiled for choice”, Stock argues.

“We continue to have a lot of issuances from domestic and offshore investors – from global asset managers to insurance companies in the US, the UK, Europe and Asia,” he says. These include global brands like Nestle, Apple and the World Bank.

Take care with index investing

As an active investor, Stock believes the Australian fixed-income market is not as efficient as it could be.

That opens opportunities, he says.

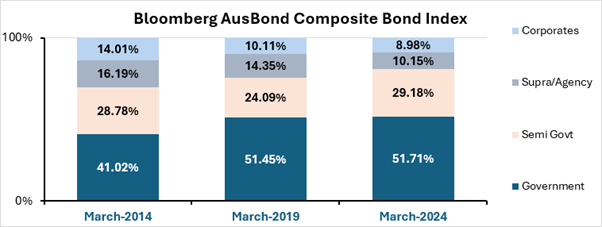

The composition of the Bloomberg AusBond Compositive Bond Index has changed significantly over the years, as the graph below shows.

Source: Bloomberg

A steep increase in government debt over the past decade means these bonds now represent the majority of the index.

Meanwhile the market has experienced strong growth in corporate and securitised debt issuance, with some paying yields at rates unheard of a decade ago.

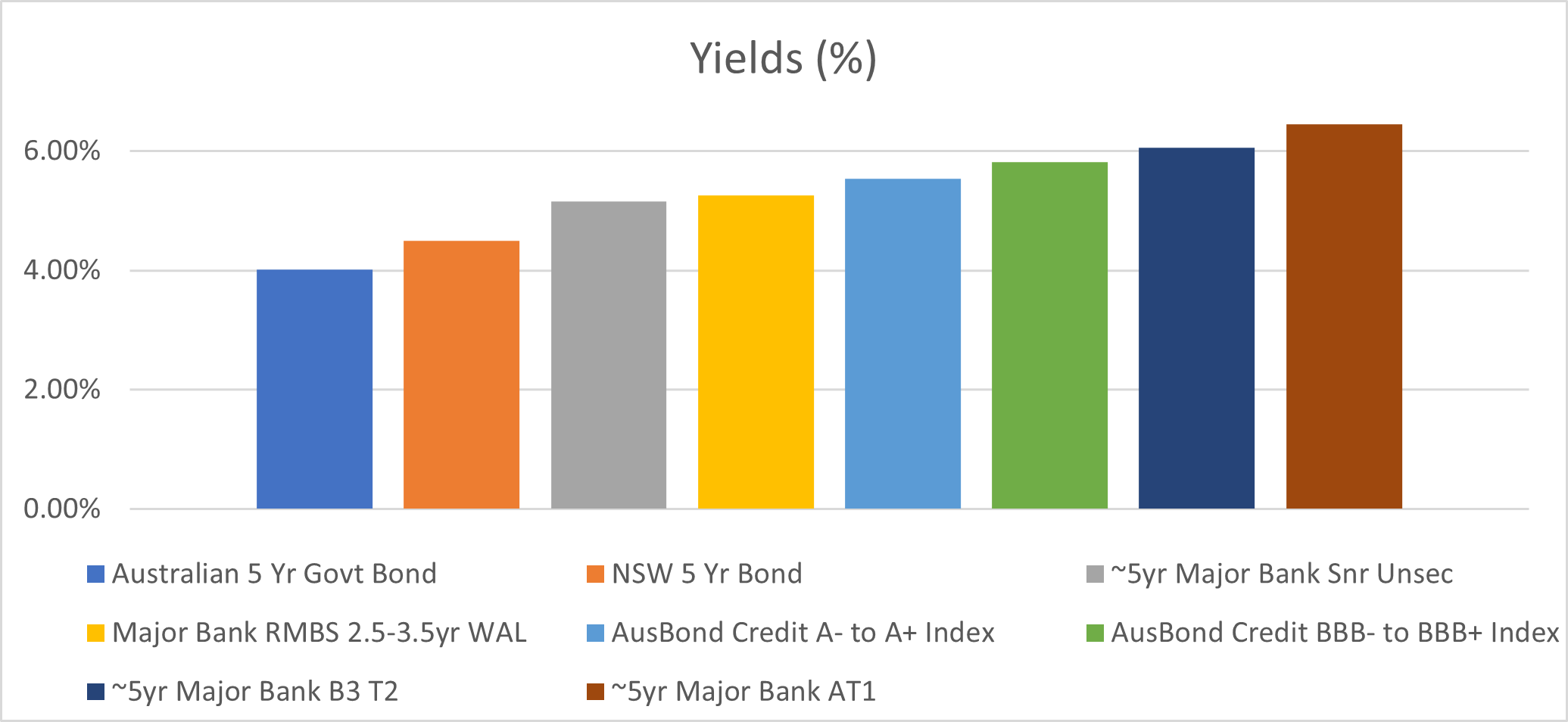

“We are seeing some of the best opportunities in over a decade for high-quality corporate bonds – institutions like banks and telecommunications companies – which can pay over 6 per cent,” Greg says.

He points to this graph, which compares a range of Australian fixed-income yields at April 30, 2024.

Source: Bloomberg

“That’s much higher than lending to federal and state governments, which represent the majority.

“What this means is the index isn’t always representing the best yield opportunities for investors,” he argues.

Sub-sector rotation ‘indispensable’

Prevailing macroeconomic climate should remain a critical determinant of the value in Australian bonds.

That’s why active management and sub-sector rotation is indispensable – particularly as volatility in the market can lead to broader spreads, elevated yields, and investment prospects for the agile, risk-aware investor.

The Perpetual Credit and Fixed Income team, including Michael Korber and Vivek Prabhu, leverage a deep, combined experience in Australian bond markets to make informed investment decisions.

As some of the industry’s most experienced fund managers, the team’s knowledge of how markets react in various circumstances helps them allocate their portfolios in each environment.

Perpetual Active Interest Fund was established as one of the first active, credit-focused bond funds in the country designed to identify and capitalise on the inconsistencies in the market.

It is close to celebrating its 20-year anniversary with the same fund manager.

Under Stock’s management, the fund has a track record of success in running its strategy through different environments and delivering returns to investors.

“With a risk-aware focus, active credit management has produced repeatable risk-adjusted returns for investors,” Stock says.

“We aren’t part of some fad – some hot, new strategy,” Greg says.

“We manage Australian bonds with an Australian perspective, and our long track record speaks for itself.”

About Perpetual’s Credit and Fixed Income team

Perpetual offers a range of cash, credit and fixed-income solutions and are specialists in investing in quality debt.

We take a highly active approach to buying and selling credit and fixed income securities and invest extensively across industries, maturities and the capital structure.

Find out more about Perpetual Active Interest Fund (Class A) including its performance data here.

Want to find out more? Contact a Perpetual account manager