As you approach retirement, you may be considering how to tackle your travel bucket list and see more of the world. Whether it’s sipping cocktails on a beach in Hawaii, trekking through Machu Picchu or enjoying Australia’s breathtaking outback terrain from the comforts of a motor home, you’ll need to make sure your wallet can handle it. Here we outline some financial considerations for travel in retirement.

In order to pursue travel in retirement, we suggest you:

- Estimate how much money you can afford to set aside for travel each year

- Plan your vacation and research costs

- Allow a buffer for the unexpected

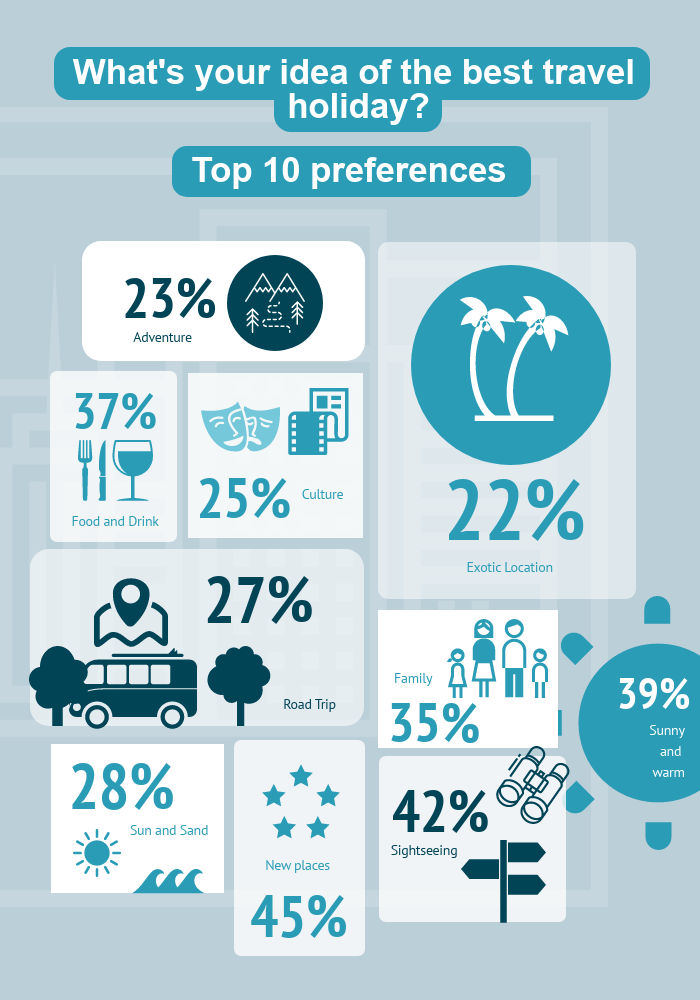

What’s your idea of the best travel holiday?

We wanted to find out more about the travel habits of Australians, so we asked 3,000 people about their preferences as part of Perpetual’s How do you feel? research study. Our findings show the best vacations involve:

Source: Lembit, G., (2017) ‘How do you feel?’, Perpetual Client Insights and Analytics, released September 2017

Source: Lembit, G., (2017) ‘How do you feel?’, Perpetual Client Insights and Analytics, released September 2017Estimate how much money you can spend on travel each year

As a first step, you need to understand how much money you can allocate towards travel in retirement. As a rule of thumb, you can typically withdraw 4% of the value of your nest egg without running out of funds in retirement. For example, if your retirement balance is $1.5 million, you’ll have about $60,000 to work with for the year.

In your budget you will need to account for tax on your withdrawal. From here, you’ll also need to estimate how much money you’ll need to meet your basic living expenses, like housing, food, clothing, and healthcare. Once you’ve accounted for tax and these essential costs, the remaining balance is how much money you'll have left over each year for travel.

Travel in retirement: How much is enough?

As a guide, the Association of Superannuation Funds of Australia (ASFA) benchmarks the annual budget needed to fund a comfortable and modest standard of living in retirement, with figures based on an assumption people own their home outright and are relatively healthy.

According to September 2019 figures, individuals and couples around age 65, looking to retire today, would need an estimated annual budget of $43,787 and $61,787 respectively to fund a comfortable retirement lifestyle. This budgets for a total of $3,264 (single) or $5,027 (couple) per year for domestic and occasional overseas vacations.

Figure 1: ASFA income standard for retirees aged around 65, annualised total1

|

Comfortable lifestyle |

||

|

Single |

Couple |

|

|

Income for living |

$43,787 |

$61,786 |

|

Domestic vacations |

$2,305.67 |

$3,509.41 |

|

Overseas vacations |

$958.39 |

$1,517.98 |

|

Overall allowance for travel |

$3,264.07 |

$5,027.38 |

|

Modest lifestyle |

||

|

Single |

Couple |

|

|

Income for living |

$27,913 |

$40,194 |

|

Domestic vacations |

$1,554.52 |

$2,452.36 |

|

Overseas vacations |

$0 |

$0 |

|

Overall allowance for travel |

$1,554.52 |

$2,452.36 |

Source: AFSA retirement standard, estimates per year in $A, as at 30 September 2019

Plan your vacations and research costs

This is an opportunity to see what destination and time of year will work best for you and your money.So, after getting a sense of how much you can afford to spend on travel, you should look for ways to maximise your budget – specifically by assessing the holidays that are most important to you and gauging how much they’ll cost. The idea is to get a more accurate quote or estimate of how much each travel adventure will set you back, rather than just guessing the cost.

We also suggest you consider and plan for all your retirement travel goals ahead of time. For example, you could prioritise the more physically demanding trips to do while you have more energy. That is, it will likely be easier to go on a hiking adventure when you’re in your 60s than it would be in your 70s.

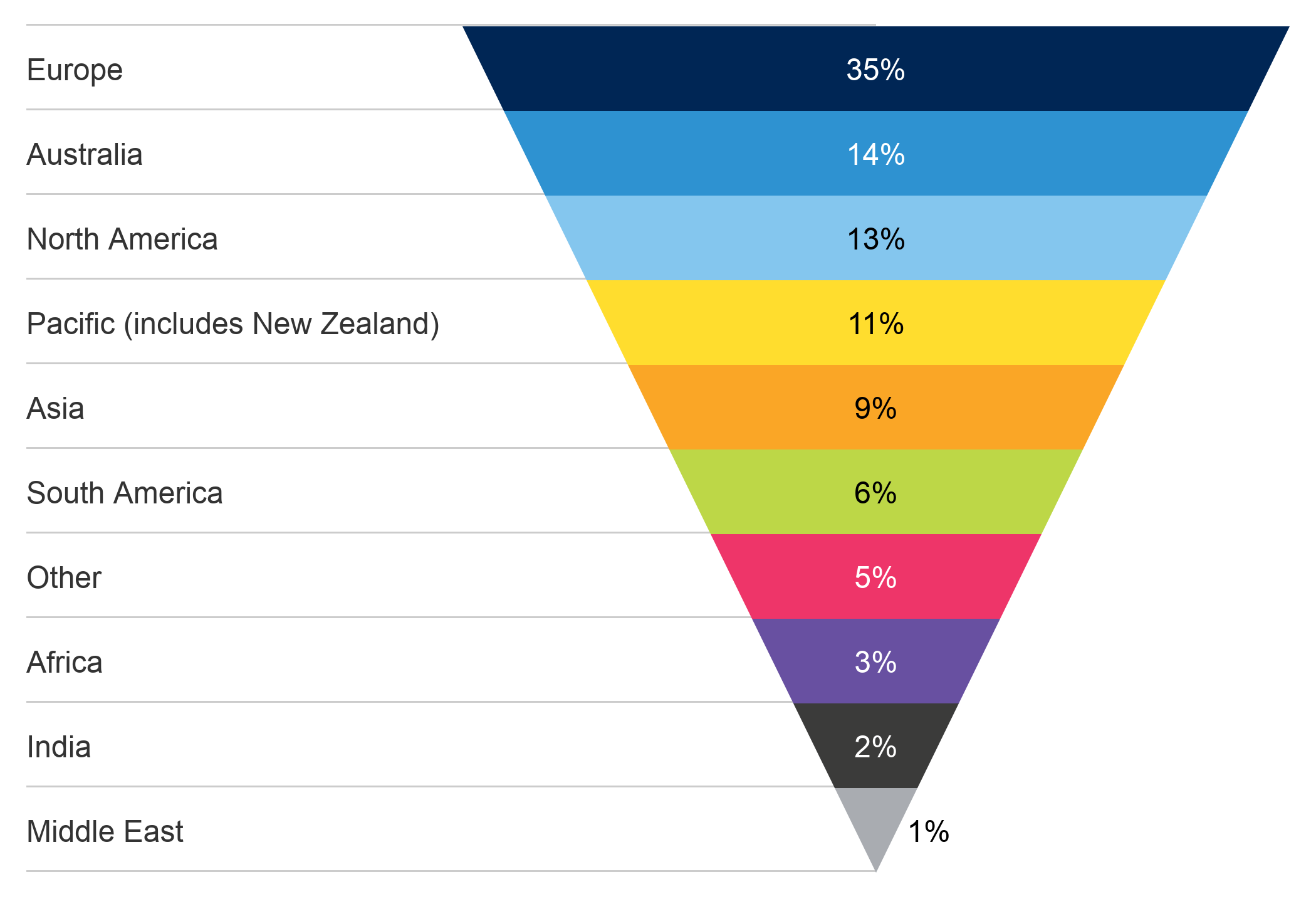

Caught the travel bug? Here are some destinations where Australians said they would like to go if they could travel anywhere in the world tomorrow.

Source: Lembit, G., (2017) ‘How do you feel?’, Perpetual Client Insights and Analytics, released September 2017

Source: Lembit, G., (2017) ‘How do you feel?’, Perpetual Client Insights and Analytics, released September 2017

Allow a buffer for the unexpected

Once you determine how much your vacations will cost, it’s important to build a buffer (some wiggle-room) into each trip's budget to account for any unknown or unforeseen expenses. You should assume that incidentals like transport and tips will cost more than expected. Extra activities or gift purchases may also come up on your holiday. While adding to your expenses, they may represent a once in a lifetime opportunity that you can’t pass up.

The last thing to remember is travel insurance. The cost of travel insurance is often a small price to pay for the degree of protection if your plans are disrupted or you encounter a health issue that forces you to cancel or alter your itinerary.

When budgeting for travel in retirement, the right financial advice can be life changing. By seeking advice earlier in life, you will have more time to build your wealth and achieve financial freedom in retirement. That’s more money to fund your desired lifestyle – which includes budgeting for things like travel.

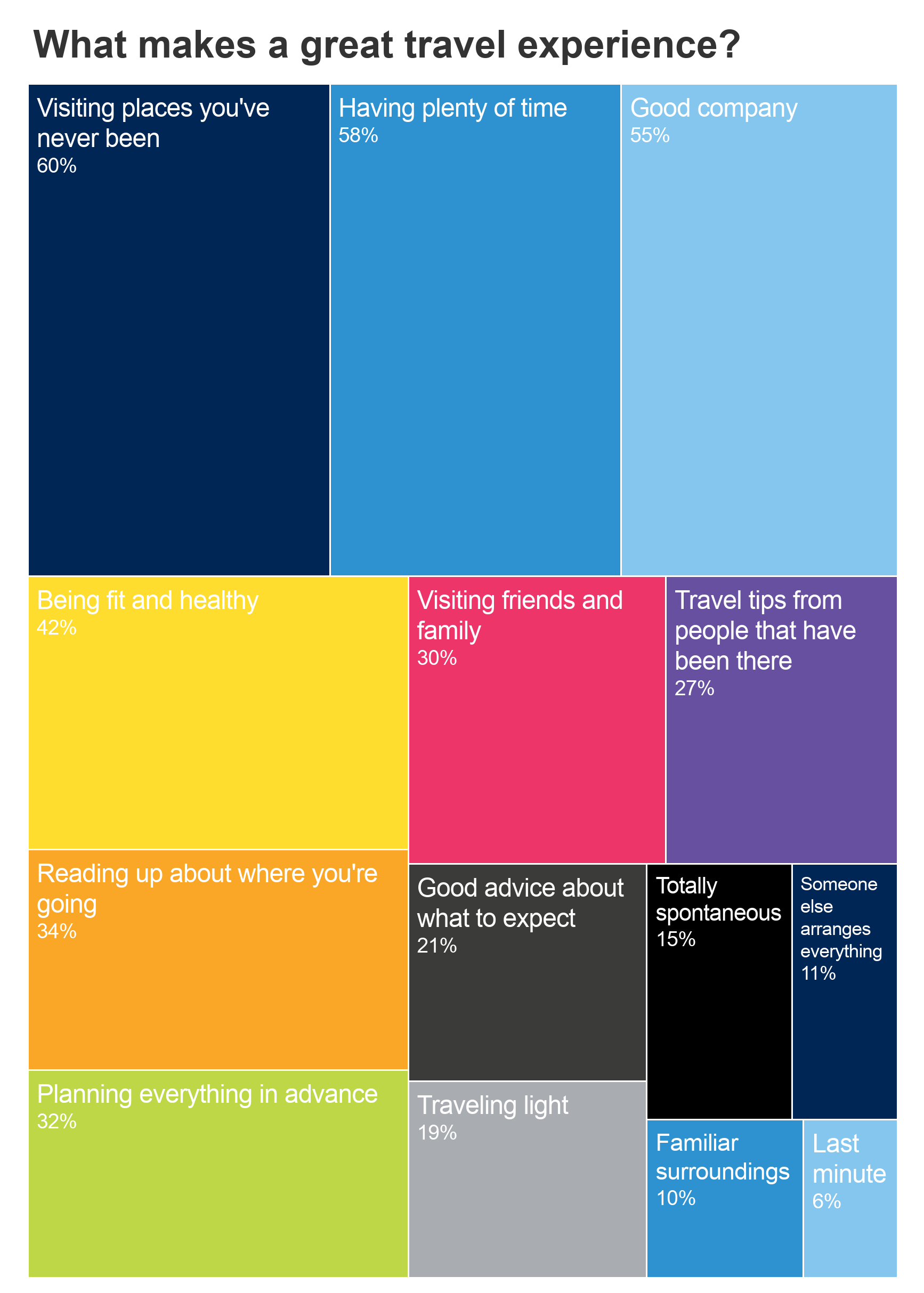

The best holidays are planned in advance

Let's return to our research for some inspiration.

Source: Lembit, G., (2017) ‘How do you feel?’, Perpetual Client Insights and Analytics, released September 2017

Source: Lembit, G., (2017) ‘How do you feel?’, Perpetual Client Insights and Analytics, released September 2017

When we asked people what makes a great travel experience, 34% said researching where you’re going and 32% said planning in advance.

Now there’s an analogy for achieving financial freedom in retirement – early planning with a clear destination in mind.

These days, retirement means more than a rocking chair and bingo. With Australians living longer and having more time for activity2, it’s important to give thought to keeping some money aside for recreation and leading a socially active life.

Traveling during retirement can be extremely meaningful and rewarding; just be sure to budget for it accordingly.