Perpetual recently asked 3,000 Australians what they care about most in life. Our ‘What do you care about?’ research project told us that Australians care a lot about the environment. People were particularly concerned about air pollution, water quality and global warming.

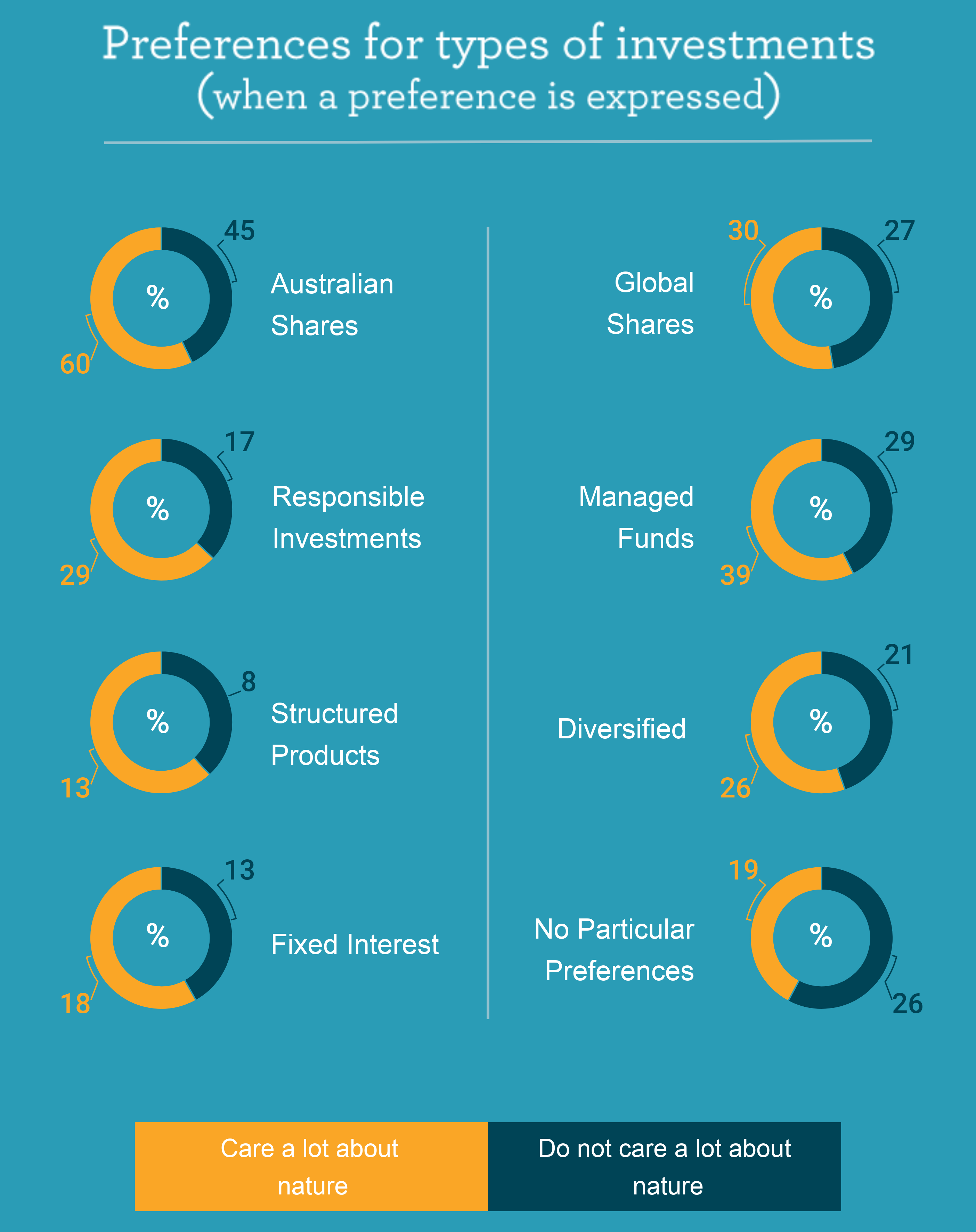

It was interesting to see these concerns reflected in investment preferences, with those caring about the environment far more interested in responsible investments. Responsible investing has enjoyed steady growth over recent years, incorporating environmental, social and governance (ESG) factors when selecting suitable investments.

Balancing your financial returns with social good is a compelling concept, but how are the investments selected and how can you be sure they align with your values? We sat down with Daniel Nelson, Senior Research Analyst at Perpetual Private, to find out more.

Q: Where do you start?

A: The first step is to ask yourself what responsible investing means to you. What are the industries you want to avoid or encourage through your investments? It’s a personal selection process you need to consider based on your values and ethics.

ESG investment funds come in a variety of shapes and sizes, each incorporating a different mix of companies across various industries. Some funds screen out companies in industries like fossil fuel, others look for companies in areas like renewable energy. That’s why you should have a clear picture of your preferences before speaking to a financial adviser about your investment options. It will help the process of finding the right responsible investments.

Q: Do you think the trend towards responsible investing will continue?

A: Absolutely. There is a groundswell of support from investors and it’s not limited to the younger generation. I think that people are more aware of the risks associated with changes to our environment.

Q: What screening processes are used to select responsible investments?

A: Some ESG funds use negative screens, others have positive screens and sometimes a combination of the two.

Let’s start with negative screening. Negative screens exclude companies that derive revenue from sectors like alcohol, tobacco and gambling. They may exclude them completely or based on a percentage of their revenue. An ethical screen may, for example, exclude companies that derive more than a specified percentage of their revenue from particular industries.

A positive screen filters companies based on their commitment to environmental, social and governance issues. These may include pollution and climate change (environmental), health and safety (social) and ethical management (governance).

Positive screening can also be used to identify best-in-class companies in other industries with an ESG rating higher than their peers.

Q: What other criteria are considered?

A: Ethical screens are only part of the process. As with any investment, ESG assets should also be analysed for value and potential return. Responsible investors should expect returns that are comparable to other types of investments.

At Perpetual Private, we assess all stocks against stringent quality investment criteria that underpin our Protect & Grow investment philosophy. We consider factors like the company’s balance sheet, quality of the management team and sustainability of earnings.

Q: How have ESG investments performed against traditional investments?

A: It is a common myth that responsible investing leads to lower returns. Responsible investing is a long term strategy which may lead to better long-term returns for investors. It also helps safeguard your investment portfolio against ESG risks that may not be considered in mainstream investments. Removing these risks from a portfolio may improve long-term performance while still allowing investors to achieve their desired ethical outcomes.

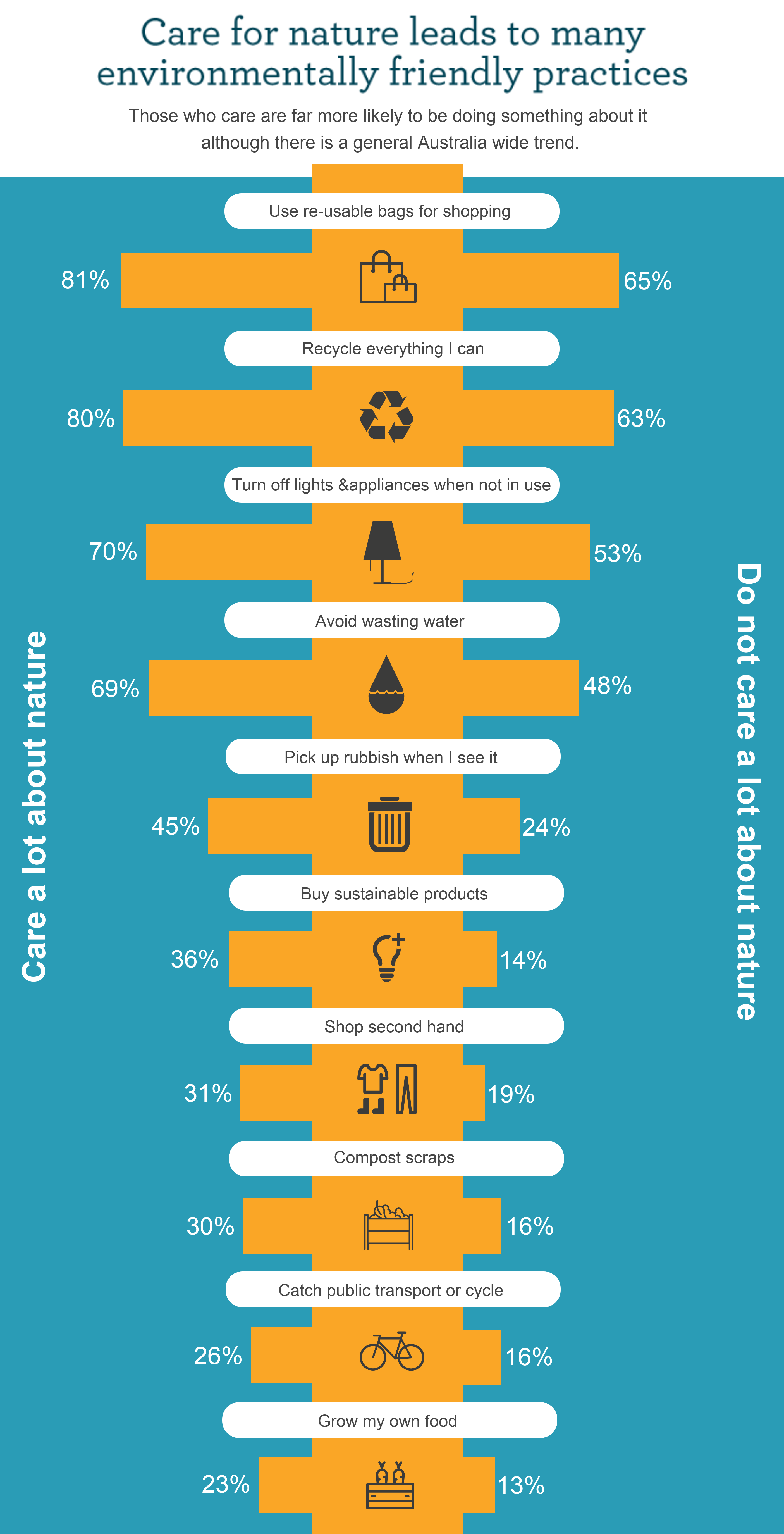

People have already changed their behaviour in other aspects of their lives, whether it is recycling or buying sustainable products. It’s a natural progression to extend their thinking to their investments and I think this trend will only strengthen from here.

Q: How does Perpetual Private help people with responsible investing?

A: We start by listening to build a clear understanding of the ethical considerations of each client. Then we have a conversation about the Perpetual Private approach to responsible investing so our clients fully understand how we select investments.

We believe responsible investors should not have to sacrifice investment performance. That’s why our process begins with Perpetual’s Protect and Grow screen, where we assess all stocks based on our disciplined, long-term approach of investing in quality companies. We will only consider a responsible investment if we believe it will generate the required level of investment return for our clients.

Companies that pass our quality filters are then screened ethically. If a company derives more than 5% of revenue from a particular set of industries (alcohol, gambling, tobacco, military etc), then they fail and are excluded from consideration. Those companies that pass are then filtered according to our social screen, where we look at how they conduct their business (code of ethics, environment, human rights etc).

Only companies that pass our quality, ethical and social screens form part of our responsible investing portfolio. This gives our clients peace of mind when it comes to their ethics and expectations of investment performance.