Want to know if your finances are really on track?

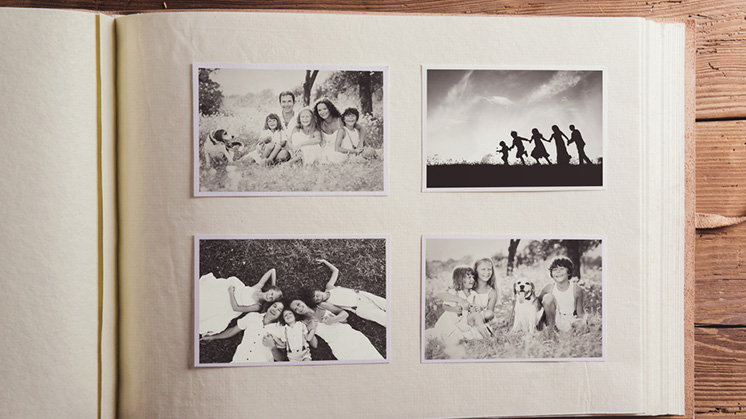

Are you worried about the quality of your financial advice? Then there’s a book we recommend. You won’t find it in the self-help section of your library. There’s no words of advice between the covers, just photographs.

It’s your family album.

A record of the biggest moments in your life.

Your wedding day. First home together. Children. Their first day at school – graduation in the blink of an eye. Your retirement. Grandchildren. Travel snaps from around the world.

Ask yourself – has your financial advice remained relevant as you flip through the pages?

Change is the only constant in life. For financial advice to endure it must adapt to your shifting circumstances.

In their own words

Our experienced financial advisers are the people who bring our philosophy to life. Here’s an insight into the difference they make with advice tailored to personal circumstances:

Richard McClelland, Senior Adviser, Perpetual Private

Judy and Patrick came to me for advice on their finances as they neared retirement. The administration of their Self-Managed Super Fund (SMSF) was an administrative burden and they wanted to know what options were available to them.

Aside from their administrative concerns, it was apparent their investment portfolio was not adequately diversified. Residential property was a major asset in their SMSF and this concentrated their risk. They were exposed to a potential downturn in the property market.

So we created a more diversified portfolio across a broader range of investments. This still includes property but also fixed interest, Australian and international shares, alternatives and cash.

Now they have their revised financial plan in place, they’re experiencing less administration burden, have a more diversified investment program and more time to do the things they want to do.

Meet Patrick and Judy

On the surface, managing a Self-Managed Super Fund (SMSF) may look straightforward. The reality, however, can be very different. Patrick and Judy Gauci share their story on why they winded down their SMSF in preparation for their retirement.

|

Meet Patrick and Judy On the surface, managing a Self-Managed Super Fund (SMSF) may look straightforward. The reality, however, can be very different. Patrick and Judy Gauci share their story on why they winded down their SMSF in preparation for their retirement. |

Richard Van der Merwe, Partner, Fordham

Bill Cook is the third generation of his family involved in the Williams Batters real estate business in Melbourne. I have been working with Bill for more than 15 years now – his family’s relationship with Fordham goes back 60 years.

Managing a family business through the generations brings complexity. You have shared family assets, sibling dynamics and generational business challenges – all need to be understood, integrated and managed at the same time as operating the business and managing risk.

To cut through the complexity, the advice we give to Bill and his family is managed through Fordham’s Family Office service – it’s an integrated solution with Fordham managing accounting, tax and business advice and Perpetual Private providing wealth management, superannuation and estate planning. I am the primary point of contact, bringing all of the services and expertise together seamlessly.

The Family Office approach makes sure nothing falls between the cracks. We help with all the business accounting and tax, but also with managing a complex set of personal financial issues – across the generations for Bill and his sister Libby and down the generations as Bill plans for the future of his business and his children.

|

Meet Bill We visit Bill Cook in the offices of Williams Batters, Melbourne, to talk about a business that’s almost a century old – and the challenge of managing a business and family and personal wealth at the same time. |

Chantelle Gregory, National Estate Planning Lead, Perpetual Private

Recently I met with Perri, a successful pharmacist and businesswoman. Over the last few years, Perri experienced big changes in her life, having divorced, remarried and grown her business to a point where she is running five pharmacies in Melbourne. While she did have a will in place, it was outdated, which meant the new businesses Perri had worked so hard to build were at risk of not being passed on to her loved ones.

What I’ve realised is that every client has something they hold very dear to them. It might be their family, their business or the charities they support. What we aim to achieve in the first meeting is to identify what clients really love and flesh that out to develop an estate planning solution to protect it.

Estate planning is a conversation about love, not death. Perri now has a plan in place to protect the people she loves most in life. I take great satisfaction that she is comfortable her revised plan accurately reflects her current situation and protects her family and business interests.

|

Meet Perri The essence of a will is not about death – it is about protecting what you love most in life. In pharmacist Perri McCarthy’s case, this involved safeguarding the future of her children and her business interests.

|

The best financial advice endures

At Perpetual, we will do more than simply listen to your life’s story, we will help shape it with your best interests at heart. From the first page of your family album to the last – and beyond to the pages that will define your legacy.

For more than 130 years, we’ve been trusted by generations of Australians to manage, grow and protect their wealth. Through wars, recessions and financial crises, we have continually evolved to meet the challenges of constant social, technological and economic change.

Yet through it all, our commitment to the best interests of our clients has remained constant. Our advice endures because our relationships do.