This summer, soak up the sun and tap into our portfolio managers’ playlists. Edited by Tamikah Bretzke

As year-end approaches and summer settles in, there’s no better time to sit back and catch up on some of the world’s best investment thinking.

In this portfolio manager playlist, top investors at Pendal and Perpetual Asset Management share their favourite resources from 2024 – offering unique insights into the ideas, stories and strategies that have helped inspire their thinking.

Thoughtful conversations from Perpetual’s deputy head of equities Anthony Aboud.

For those tired of agenda-driven, clickbait journalism, Anthony recommends the Lex Fridman Podcast.

This long-form podcast presents thought-provoking conversations with some of the world’s most influential people – from Elon Musk and Bernie Sanders to Mark Cuban and Jeff Bezos.

“I like Freidman’s interviewing style,” Anthony says.

“Often the world simplistically paints people as either good or bad, left wing or right wing – but the world is much more nuanced than that.

“Here, in often three-hour conversations, we really understand what motivates them and get a deeper understanding of how they see the world.”

A standout episode for Anthony was hearing Elon Musk discuss developments with Neuralink.

Empowering ideas from Pendal’s head of income strategies Amy Xie Patrick

As the founder of EmpowHER, a Pendal inhouse development program for women, it’s no surprise that Amy’s suggestions are aimed at those hoping to rise and thrive – from How Women Rise by Sally Helgesen and Marshal Goldsmith to Essentialism by Greg McKeown.

“The first book is a guide for addressing the habits that help women succeed – until a certain point – in their careers and then hold them back from further progress,” Amy says.

“The second helps with pleaser and perfectionist tendencies.

“When you do the work to identify what is truly important, it becomes easier to say ‘no’ to requests that don’t align with your purpose.”

For podcast fans, Amy highlights a range of industry titles such as Acquired, The Knowledge Project and the NAB Morning Call, which offers a daily summary of relevant market news.

Nature and narrative from Pendal’s Asian equities expert and senior portfolio manager Samir Mehta.

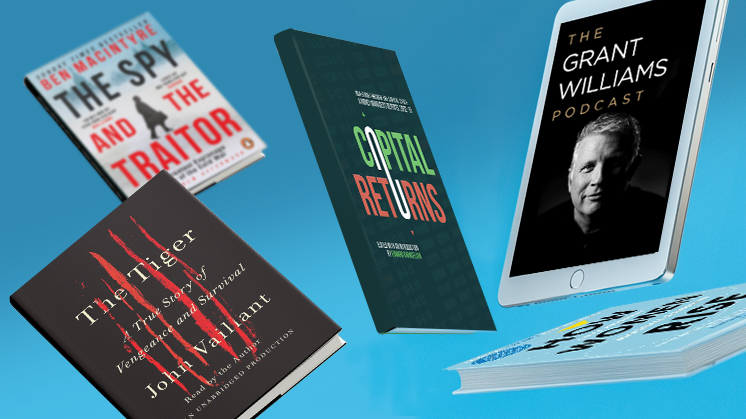

Samir’s top pick is The Tiger by John Vaillant – the true story of a Siberian tiger’s strategic pursuit of a poacher in the Russian wilderness.

The Tiger explores the fraught relationship between nature and humanity, the moral dilemmas of survival, and the magnificence of the tiger – not merely as an animal, but as “a near-mythical force of nature that embodies both beauty and danger.

Samir says: “It’s deeply rooted in the sociopolitical and economic realities of post-Soviet Russia, where poverty, desperation, and dwindling natural resources drive illegal poaching.

“Vaillant’s exploration of these factors adds richness to the narrative, showing how human actions, shaped by larger systems, contribute to environmental crises – a must-read.”

For an “auditory delight”, Samir recommends Search Engine by PJ Vogt.

As a blend of journalism, storytelling and humour, Search Engine takes listeners on deep dives into quirky and profound questions on all things weird and wonderful.

“Search Engine is worth listening to because it satisfies that innate human desire to understand the world better,” Samir says.

“Known for his ‘radio voice’ and captivating storytelling, PJ doesn’t just provide answers – he invites listeners to join him in the exploration.”

Story and strategy from Perpetual’s portfolio manager and senior high-yield analyst Michael Murphy.

For readers, Michael recommends Merchants of Debt: KKR and the Mortgaging of American Business by George Anders.

“The book details the rise of the firm and its use of debt to fund takeovers during the leveraged buyout boom of the 1980s,” he says.

“It gives an interesting perspective of the development of the high-yield debt market that supported these takeovers.”

For listeners, Michael suggests Acquired – a podcast that tells the stories, and reveals the strategies, of great companies.

With well-researched episodes, listeners get a detailed history of each company and an in-depth analysis of the factors driving its success.

“On each episode, I’ve learnt interesting new things about companies I thought I already knew very well,” Michael marvels.

Some of the episodes he particularly enjoyed included analysis on companies such as Microsoft, Nike, IKEA, Renaissance Technologies and Porsche.

Insights for investophiles from Pendal portfolio manager and investment analyst Elise McKay.

Investing may be what Elise does, but it’s also something she enjoys – and she has plenty of suggestions for other ‘investophiles’ to help keep their minds sharp over the summer break.

“My all-time favourite investing book is Capital Returns: Investing Through the Capital Cycle by Edward Chancellor,” she shares.

However, Elise also enjoyed reading Kate Raworth’s Donut Economics: Seven Ways to Think Like a 21st Century Economist as well as Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism by Jeff Gramm.

Prefer to listen while you learn?

Elise suggests Bloomberg Surveillance for all things markets, Monetary Matters and Macro Voices for all things macroeconomics, and Finding Mastery for those interested in high-performance psychology.

Tech and innovation from Pendal portfolio manager Brenton Saunders.

Like Michael and Amy, Brenton also suggests Acquired – in particular, the podcast’s three-part series on Nvidia.

“It’s a fascinating journey through the history of what is today one of the world’s most important tech companies, seen through the eyes of two market and tech-savvy enthusiasts,” he says.

“It’s also educational, hearing about where the technology is headed and how it may get there.”

Brenton also found the episode on Renaissance Technologies a “fascinating and educational” listen that recounts the history of one of the earliest and most successful quant hedge funds in the world as it used one of the first applications of artificial intelligence.

Historic perspectives from Perpetual’s head of credit research and senior portfolio manager Greg Stock.

Who needs James Bond when readers can have the real thing?

One of Greg’s top picks is The Spy and the Traitor by Ben Macintyre – a best-selling true story about one of the most renowned double agents for Great Britain and MI6, Oleg Gordievsky.

“Despite its age, the relevance is still apparent,” he says.

“Surely one of the best espionage books ever written and totally captivating.”

Greg also highlights The Fourth Turning by Neil Howe and William Strauss, as a “fascinating and essential read for anyone interest in generational perspectives on markets”.

His top podcast pick is The Grant Williams Podcast, which features conversations with market strategists, veterans, and other strategic thinkers.

“I’d call out the episode with Dave Dredge,” he notes.

“It addresses all things convexity, volatility, market distortions, and growing fragility in the financial system and rising government debt levels.”