Head of Australian equities, Vince Pezzullo, shares an update with investors on why the rapid market sell-off opens the door to a world of opportunity.

- Parts of the market “well overdue” for correction

- Perpetual has been preparing for this sell-off

- Find out more about Perpetual Equity Investment Company (ASX:PIC)

The sell-off in equities has come swiftly and savagely.

Trump’s tariff announcement may have been the immediate catalyst for the turn in sentiment. But anyone watching markets in recent months should have noted that equity valuations had run well ahead of market fundamentals, especially in growth-orientated sectors such as information technology.

These parts of the market were well overdue for a correction.

At the same time, it would be easy to mischaracterise the tariff announcement itself. These tariffs are part of a carefully considered strategy by the Trump administration to deliberately alter global economic relations.

The days of the US running vast trade and budget surpluses are coming to an end – especially as US public debt soars to US$36.6 trillion, nearly $10 trillion more than US GDP.

Deep thinkers inside the administration, such as Treasury Sec. Scott Bessent, have for many months highlighted the need to adopt a suite of policies to speed up economic growth to 3%.

These include reduction in regulation, producing more energy, cutting the budget deficit and a range of other measures, including a prospective “Mar a Lago Accord” (inspired by the Plaza Accord in 1985) to alter the unsustainable direction of global economic flows and bring them back into balance.

Threats of tariffs, as outlined last week, were an instrumental part of achieving this re-balance in economic relations. The aim was to target trade imbalances with tariffs unless those countries agreed to policies to achieve greater trade equilibrium with the US.

Unpicking the exact contribution of each of these factors to the current market turmoil will be hotly debated for a long time to come.

Portfolio implications

We have been preparing for this sell-off by positioning ourselves in great businesses at reasonable prices and holding elevated levels of cash.

Perpetual’s four quality filters have been the bedrock of our process for many decades through multiple market crises.

By targeting quality companies with solid balance sheets, good prospects and recurring earnings we are continually assessing which companies to allocate capital to in order to achieve the long-term goals of our clients.

This approach means we can provide clients with some downside protection in negative markets – such as the one we're experiencing now – while preserving capital to position clients to recover well when the turmoil inevitably fades.

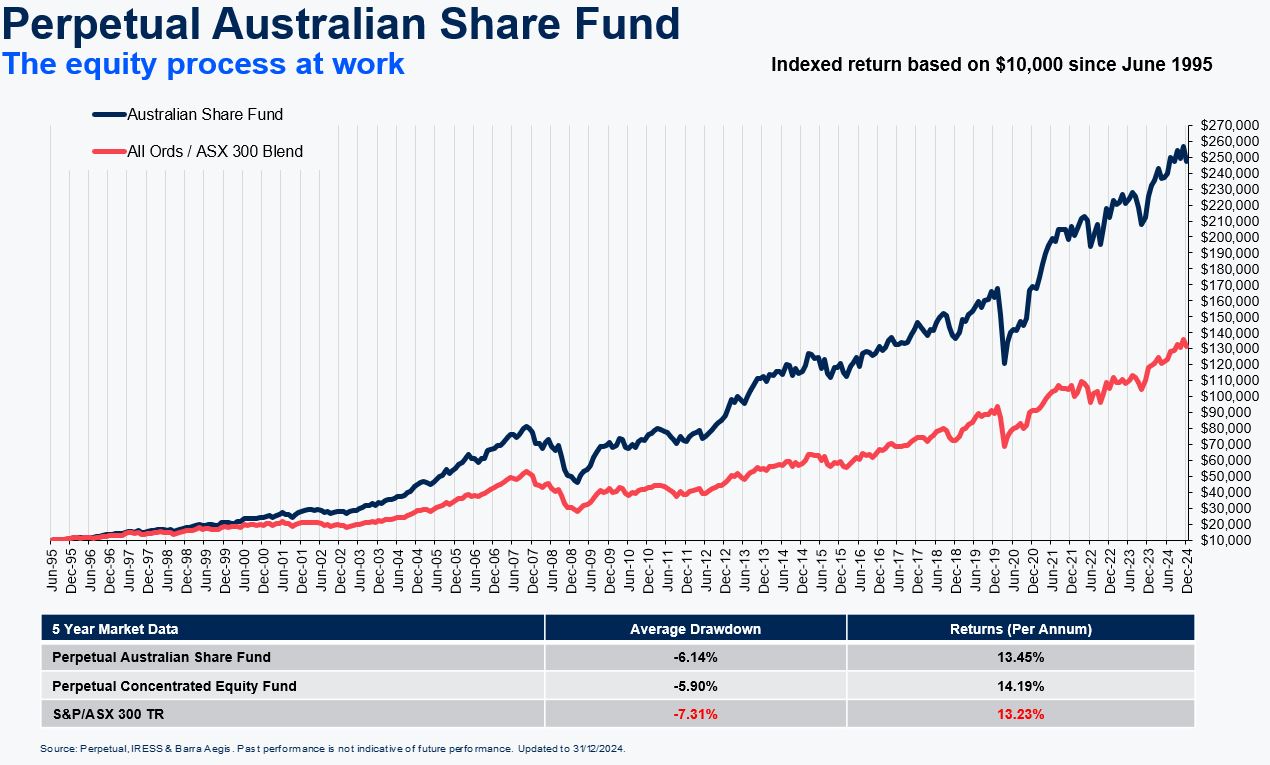

As the market sell-off unfolds, our portfolios are holding up relatively well, as they usually do in market drawdowns (see chart).

Our funds also have cash reserves ready to deploy into opportunities as they present themselves.

Historically this has been an excellent time to pick up high-quality companies that temporarily find themselves caught in market dislocations.

As always, while this is unfortunate for forced or panic-sellers, it can be to the benefit of our clients when we find them.

Opportunities emerging

President John F Kennedy noted that with crisis and danger comes “opportunity”.

A recent overseas research trip confirmed several things for us:

1. The overall market set-up offshore is better than many realise, despite fears of a global recession. For example, UK and US banks are much cheaper than Australia.

Sometimes there are reasons for this and bank regulators in those markets have been onerous in constraining credit creation (and value for shareholders). However, this appears to be changing and could throw up opportunities just as our banking sector looks very expensive and is rolling into an economic downturn.

UK households are also coming out of a 15-year de-leveraging cycle. Market sentiment is very low there, but it wouldn’t take much for that very cheap market to bounce with even a small amount of positive news.

2. There are pockets of great value right across the US and Europe despite the ongoing obsession with the Magnificent 7 in sectors as diverse as construction, automotive, gaming and entertainment.

These are often very well-managed businesses with huge addressable markets and demonstrated success in growing their businesses organically or through bolt on acquisitions.

Often, they are the number-one operator, though their markets are still very fragmented and there are many years of consolidation to drive business growth. Yet these great businesses – often small-to-mid cap – are often below the radar of most investors and can generate great returns at the right time.

3. Our existing holdings are well positioned.

On our trip we visited companies or assets owned by Australian-based companies in the US and Europe. Although sometimes it's risky for Australian-based companies to venture offshore, some corporates do it very well.

Many enjoy full or part ownership of rapidly growing businesses that will drive up the value of their Australian-domiciled head stock up for years to come.

We have a much clearer view about the quality and potential of these assets when we are able to see them directly and speak with management. We also identified a number of opportunities adjacent to existing holdings.

As always, we will continue to work hard to make the most of every market and generate the long-term alpha that our clients need.

About Vince Pezzullo and Perpetual Equity Investment Company (ASX:PIC)

Vince is Perpetual’s head of equities and portfolio manager of Perpetual Equity Investment Company (ASX:PIC).

Vince has more than 20 years of experience in financial services including global experience as an analyst and portfolio manager.

Perpetual Equity Investment Company Limited (ASX:PIC) is a listed investment company which provides a simple and transparent way to invest in a diversified portfolio of high quality Australian and global listed securities.

PIC is managed to provide investors with an income stream and long-term capital growth.

Perpetual is a pioneer in Australian quality and value investing, with a heritage dating back to 1886.

We have a track record of contributing value through “active ownership” and deep research.

Find out about Perpetual Equity Investment Company (ASX:PIC)

Browse Perpetual’s Australian equities capabilities

Want to know more? Contact a Perpetual account manager