Value managers globally may share some common beliefs in terms of investment philosophy – broadly defined as buying companies that trade at a discount to their estimate of fair value – but their resulting portfolio characteristics and ultimate performance can vary dramatically. Some will do better in growth environments but fail to keep pace with their peers in a value-led market. All of which begs the question: how well do you know your value managers and what differentiates Barrow Hanley in the prevailing market environment?

Perpetual’s decision to appoint specialist investment manager Barrow Hanley to manage the Perpetual Global Share Fund in September 2020 gives Australian investors access to the investment experience of a highly rated, Dallas-based global equities team. Barrow Hanley has a 40-year track record of value investing and a broad, blue-chip, institutional client base – many of whom have been with the company for more than 20 years – this article aims to look “under the hood” at the investment strategies employed by global value managers.

Value strategies have differing characteristics which contribute to performance over various market cycles. This means that not all styles will benefit to the same degree as value comes back into favour across global equities markets. To better understand the biases of different value strategies and how these biases impact the resulting portfolio characteristics, we have taken a subset of the eVestment Global Value universe and categorized 57 strategies into three types of value – traditional (sometimes called deep value), defensive, and relative value. We believe that, in a broad sense, these three buckets capture the majority of styles across predominatly US / global value managers. Although most value managers will have stocks from any or all of these styles, a manager’s selection criteria will generally cause its overall portfolio to fit within one of these three categories.

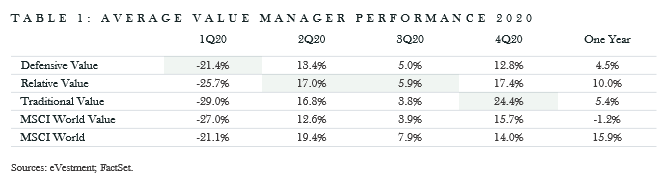

In 2020, as markets rotated violently throughout the year, not one value style performed consistently better than another. Looking at Table 1, an investor in the first quarter of 2020 would have been pleased to own a defensive value manager, as these on average performed better than their relative and traditional value peers. However, in the ensuing quarters, defensive value managers gave way to better-performing relative value peers, which eventually gave way to better performing traditional value peers in the final quarter of 2020. This same pattern can be seen over various market cycles, as different styles of value move in and out of favour depending on the market environment. This performance disparity shows the importance of exposure to a value manager that is well positioned to take advantage of scenarios where value outperforms growth.

Value-style exposures

In considering how a strategy fits into a specific value style, defensive and traditional value managers tend to be the easiest to define based on valuation metrics, beta, upside/downside capture and sector positioning. However, relative strategies are a bit more difficult, as these managers can have tendencies that cause them to lean toward either defensive or traditional and, in some cases, even more closely to broad benchmark-like exposures.

Broadly, defensive strategies will typically have higher exposure to defensive sectors such as Consumer Staples, Health Care and Utilities, while being underweight more cyclical sectors such as Energy, Financials and Materials. Conversely, traditional value peers typically have a greater weight to the more cyclical areas of the market such as Energy, Materials and Financials and less exposure to Consumer Staples, Health Care, and Utilities. Finally, relative value strategies stand out in their larger ownership within the Information Technology, Communication Services, and Consumer Discretionary sectors while, like defensive strategies, having less exposure to Financials, Energy, and Materials sectors.

Accordingly, given the global equities environment we have seen over the last 3-5 years in which investors have favoured safety and, in many cases, found this perceived safety in Information Technology, defensive and relative value strategies have benefitted from this positioning while traditional strategies favouring more cyclical areas of the market have lagged. However, it is worth considering how clients will be placed when the market reverts to favouring the cheaper areas of the market. Is the style of value manager one chooses sufficiently exposed to these securities?

Conclusion

We recognize that we are in unprecedented times as the world is engulfed in a pandemic that has meaningfully impacted economic growth. However, with the roll-out of vaccines due to accelerate, and given the monetary stimulus being pushed into global economies, we believe markets will look more like those we experience when markets are confident about economic growth – resulting in a return to favouring value stocks. But how well do you know your value manager, and how likely is it that your value manager will perform strongly in an ensuing value environment?

Not all strategies will perform equally, and it is worth noting that traditional value strategies have a higher correlation with the value index versus their defensive and relative peers. Barrow Hanley has seen multiple market cycles over its 42-year history and is familiar with navigating tumultuous periods. Importantly, this traditional style of investing differs from the crowd, as the manager look to invest in both cyclical and defensive companies, depending on where it sees the greatest market dislocations.

Find out more about the Perpetual Global Share Fund managed by Barrow Hanley.