Please try the following to find what you’re looking for:

- Check your spelling

- Try different words or word combinations (E.g. "fund form")

Supporting investors to understand how their portfolios align with their values.

Increasingly, clients want to invest with purpose and seek alignment with their values.

Perpetual Private works with families, not-for-profits, philanthropists and investors to structure portfolios designed to align with their values and achieve attractive long-term returns.

Partnering with EthosESG, our clients have access to reporting that provides visibility on the impact their portfolios have on the environmental and social causes they deeply care about.

Our approach to responsible investing

We believe that environmental, social and governance (ESG) factors should be considered as part of investment analysis and decision making, as they are key components to building long-term sustainable value.

We make active investment decisions for single and multi-asset class multi-manager funds and portfolios, as well as recommendations of managed and listed securities through model portfolios. We have dedicated portfolios with an ethical focus designed to meet our clients’ needs including a direct equities portfolio.

Central to our investment decisions are:

- ESG integration: We integrate ESG factors into our decision-making process where we believe those factors to be material to the current or future financial performance of the asset.

- Screening: We believe the most effective ESG approach includes a combination of divestment and active engagement. We have removed Tobacco – as defined by the Global Industry Classification Standards (GICS) – from our direct equity and externally managed investment mandates (where applicable in multi-manager implemented portfolios). Other screens can be catered for on a client-by-client basis.

- Active ownership and engagement: We delegate shareholder voting to the managers we invest with. Therefore, as part of our manager selection process we assess voting policies to ensure their approach considers the best financial interests of investors and aligns to our policies.

- Sustainable investment options: We can align investments with the elements of ESG that are most meaningful to our clients through a range of ESG model portfolios and approved managers that identify and target specific ESG themes more directly.

Our financial advisers take you through a four-step process.

- Beliefs and values exploration: to understand what your organisation or family’s beliefs are when it comes to responsible investment and how they should be reflected within your portfolio.

- Portfolio assessment: to evaluate the impact of your portfolio based on identified values and beliefs.

- Portfolio review: to determine alignment with your beliefs and values and begin the conversation around closer alignment.

- Ongoing annual reviews: to ensure continuous assessment and adjustments as needed.

Read our six-step guide to building a responsible investment portfolio for not-for-profit organisations.

The Perpetual Private manager selection process integrates ESG considerations as part of the due diligence of all investment managers. Part of our approach is to understand how these managers identify and manage ESG opportunities and risks. This may include:

Monitoring appointed investment managers’ ESG policies and how they incorporate ESG risk factors into their process.

- Where mandates have been implemented, this will involve a look through to the underlying holdings. If there are any holdings that do not appear to align with a manager’s ESG policy, we will seek explanation.

- For funds, we seek and review reporting from the managers.

Evaluating the ESG profile of our investments, where possible or applicable. For example;

- it is not possible to assess closed end structures that are yet to make an investment; and,

- it is not applicable to assess hedge funds that predominantly invest in futures and derivatives

Reporting annually on our approach and implementation of responsible investing

Reviewing ESG policies as markets, legislation, regulation and clients’ needs change.

We recognise the challenges faced by investors wanting to invest more responsibly – from a lack of transparency on the impact of their holdings, to the desire for impact beyond screens.

We've partnered with EthosESG to provide interactive ESG reporting that addresses these challenges head-on.

Our clients – from not-for-profit organisations and philanthropists looking to invest in line with their missions, to values-driven individuals and families – can request access to EthosESG’s portfolio reporting to help them understand the alignment with their values and causes.

Clients can use the transparent, personalised and nuanced insights to have meaningful conversations with their adviser around the impact of their investment portfolio to ensure their investments not only align with their financial goals but also their beliefs and values.

Partnering with EthosESG to provide ESG reporting

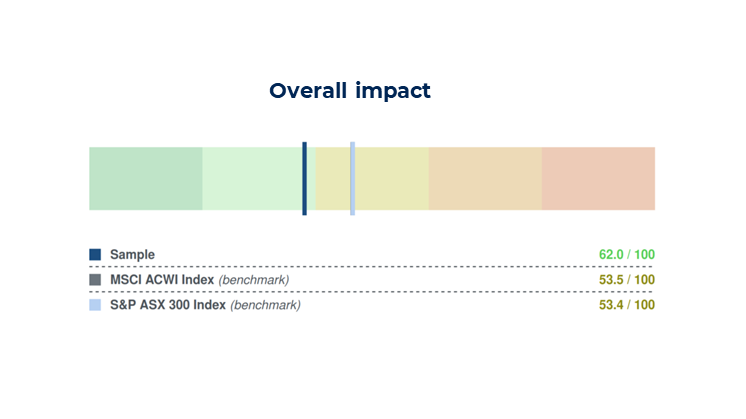

Overall impact

You can have visibility over your portfolio's impact, relative to a benchmark. To do this, EthosESG compares the weighted-average score of the portfolio to the average score of all funds, for selected causes such as climate, equality, education, health and justice.

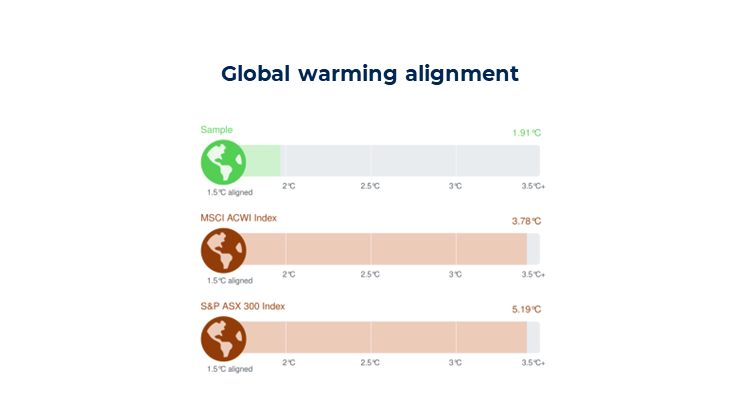

Global warming alignment

The EthosESG reporting estimates the degrees Celsius of global warming that the portfolio may be aligned with. It estimates how well-aligned the portfolio could be with the Paris Agreement on climate change mitigation, adaptation, and finance.

The degrees Celsius warming of the portfolio is calculated as the weighted-average degrees Celsius warming potential of portfolio holdings, using current emissions amounts and emissions reduction targets from the Science-Based Targets Initiative.

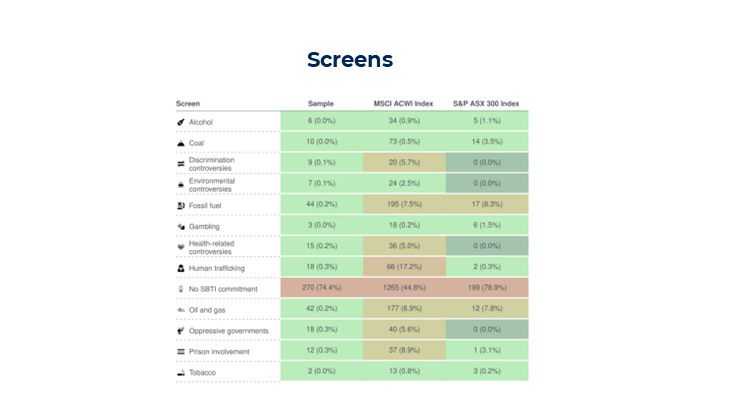

Screens

The EthosESG reporting can show you the number and percentage of companies held by the portfolio (by weight) that fail various ESG screens.

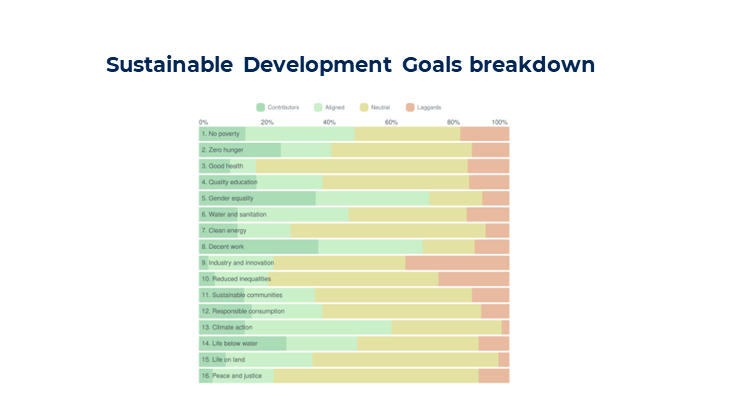

Sustainable Development Goals breakdown

EthosESG estimates the weight of your portfolio companies assessed as contributors, aligned, neutral, or laggards for each of the United Nations Sustainable Development Goals (SDGs). The SDGs are 17 interlinked global goals designed to be a "blueprint to achieve a better and more sustainable future for all." The SDGs were set up in 2015 by the United Nations General Assembly and are intended to be achieved by the year 2030.

Find out more about EthosESG's rating methodology

Conversations on responsible investing

In this video Marielle Latour, Chair of Autism Spectrum Australia’s (Aspect) Finance, Audit and Risk Committee, discusses the need to understand the ESG alignment of Aspect’s portfolio with their core purpose and values, the conversations it sparked at a board level, and the most useful and surprising elements of the process they went through.

Perpetual Private’s Responsible Investment Policy

Perpetual Private is a signatory to the United Nations Principles for Responsible Investment. We incorporate ESG issues into all our investment analysis and decision-making processes where we believe those factors are material to the current or future financial performance of the asset.

Our Responsible Investment Policy sets out Perpetual Private’s approach for how we consider Environmental, Social and Governance factors as part of our investment decision-making and ownership practices.

Learn more

Contact our team today

Take the first step to aligning your investments with your values.

Perpetual Private advice and services are provided by Perpetual Trustee Company Limited (PTCo) ABN 42 000 001 007, AFSL 236643. This information was prepared and used by PTCo. It contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The information is believed to be accurate at the time of compilation and is provided in good faith.

PTCo do not warrant the accuracy or completeness of any information contributed by a third party. This information, including any assumptions and conclusions is not intended to be a comprehensive statement of relevant practice or law that is often complex and can change. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital. Past performance is not indicative of future performance.

The information on this website is intended for Australian residents or citizens who are currently located in Australia, or where expressly indicated, New Zealand residents or citizens who are currently located in New Zealand only, and should not be relied on by residents or citizens of any other jurisdiction. By clicking the “Proceed” button below, you are agreeing to the Terms & Conditions of use.

Please read this information carefully as it governs your use of this website. Except as otherwise indicated, the contents of this website and the products and services are intended for persons residing in the United States, and the information on this website is only for such persons. This website is not directed to any person in any jurisdiction where its publication or availability is prohibited. Persons in such jurisdictions must not use this website. By clicking the “Proceed” button below, you are agreeing to these terms.

Please read this information carefully as it governs your use of this website. The contents of this website and the products and services mentioned are intended for persons residing in Singapore, and the information on this website if only for such persons. This website is not directed to any person in any jurisdiction where its publication or availability is prohibited. By clicking the “Proceed” button below, you are agreeing to these terms.

This information and the terms of use are subject to change at any time without notice. The contents of this website are intended for residents and citizens of the United Kingdom, and the European Union, and should not be relied on by residents or citizens of other jurisdictions. All investment products and services referenced in this website are managed and offered by either JOHCM or its affiliates within the Perpetual Limited group of companies ("Perpetual Affiliates"). By clicking the “Proceed” button below, you are agreeing to the Terms & Conditions of use.

This information and the terms of use are subject to change at any time without notice. The contents of this website are intended for residents and citizens of the United Kingdom, and the European Union, and should not be relied on by residents or citizens of other jurisdictions. All investment products and services referenced in this website are managed and offered by either JOHCM or its affiliates within the Perpetual Limited group of companies ("Perpetual Affiliates"). By clicking the “Proceed” button below, you are agreeing to the Terms & Conditions of use.